AI investing in 20 bullet points

Posted on LinkedIn on Aug 5, 2024

Click here to original post on LinkedIn.

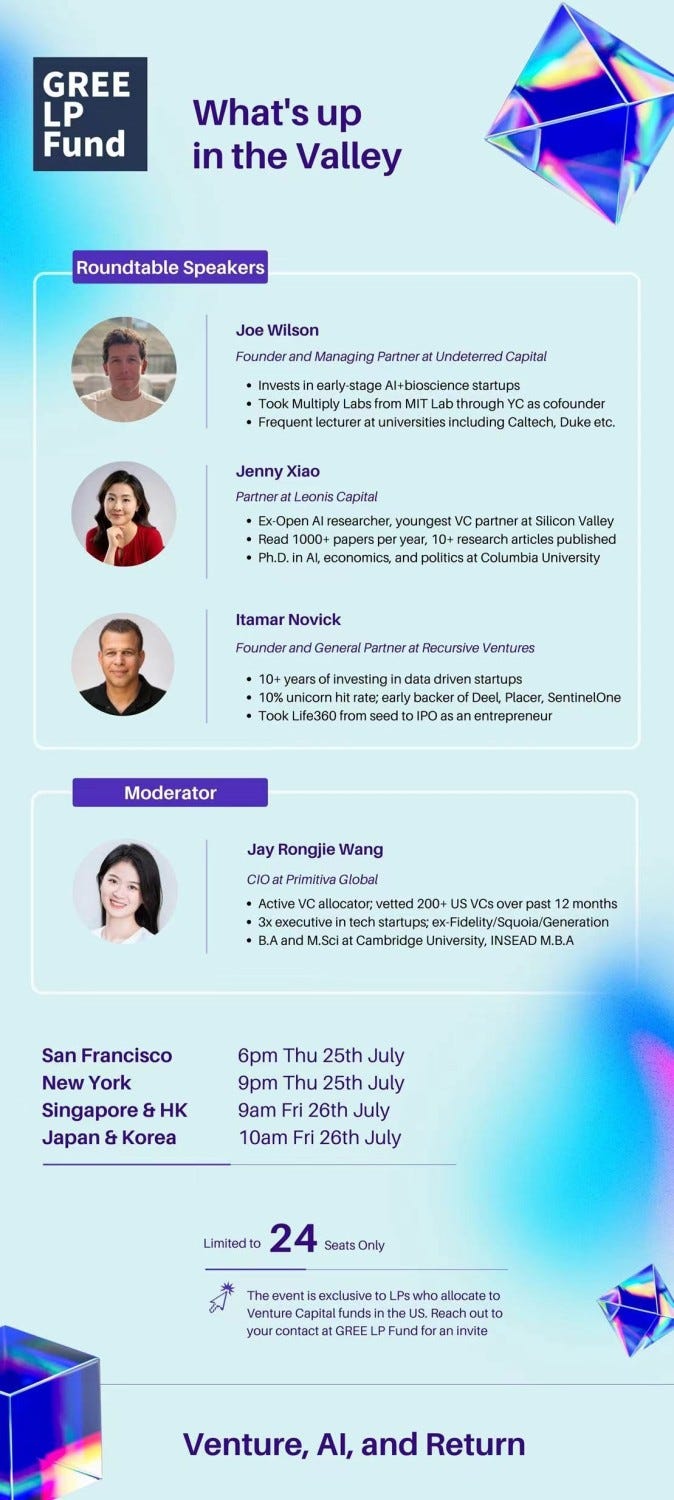

On July 25th, I had the honor to moderate an outstanding pannel roundtable with some of the best early-stage venture capitalists: Jake Ellowitz Itamar Novick Jenny Xiao Joe Wilson, joined by 25 enthusiastic LPs who also contributed great questions and observations.

Thanks to Youngrok Kim and the GREE LP Fund team for organizing such a thought-provoking event. Here are my quick takeaways summarized in 20 bullet points:

The AI Bubble

1) AI is currently overhyped, and the bubble can burst anytime, with the public market going first and then Series C->B->A seeing down/flat-round, just like what happened to the wider VC market in 2022

2) Early stage funding sees concentration in superstar founder teams working on "the new AI," leaving the rest of the pack, including predictive AI companies, quite under-funded

3) Opportunities lie in fairly-valued, early-stage companies that solve real customer problems that may not be in the most sexy industries

AI+SaaS

4) This new wave of AI applications have not yet delivered order-of-magnitude cost reductions at the enterprise level, nor have they provided a 10x better or smarter user experience which is what will convince users to switch from existing software solutions that have none-zero barrier to switch

5) The capability gap between promise and reality could be a good reason to invest in early stage right now - be there and ready when cost does eventually come down enough

6) While chip companies play a major role in AI cost reduction, it could be a bit too late to fund startups due to NVIDIA's dominance and the intense competition from the next-runner-ups

7) Companies like together.ai and inference.ai will help AI models scale more cheaply, but think twice for long-term investment because these are hard to differentiate from the AWS of the world

8) The application layer is entering an agentic era, where users seek agentic experiences, as already demonstrated by the mass adoption of Perplexity.ai among teenagers in the US

9) The future lies in multi-agent systems, using several smaller AI agents to perform their specialized tasks collaboratively

10) GenAI will become ubiquitous, similar to how software is today, and people will stop talking about GenAI

AI+robotics

11) Humanoid robots might fall into edge cases due to suboptimal bipedal structure, leading companies to pivot and simplify robotic systems to core elements for solving specific problems

12) Robotics faces challenges in training due to insufficient data, making it more like a next 10-20 year opportunity rather than 3-5 years

13) Making robotics is much cheaper today than 5 years ago, partly because of China, but geopolitical tensions are posing a challenge to US robotics companies to reach economic viability

14) LLMs are likely not the optimal model for robotics, but LLMs could make it cheaper to build sophisticated, robot-specific descriptive and discriminative algorithms

AI+biotech

15) Pure drug discovery companies are difficult bet on, partly due to a lack of discernible data, but also because there are so many of them, despite it still being the biggest segment to deploy capital in

16) Investment opportunities lie in those less optimized processes in drug development pipelines such as animal trials and clinical trials.

17) AI is underutilized in diagnostics and medical devices. Companies collecting proprietary data could be worth looking at

18) Throwing massive compute resources to replicate a GPT-moment has not worked so far in the biotech sector

AI+Crypto

19) Web3 and AI show limited potential in integration due to efficiency and security issues in decentralized computing

20) The AI and crypto communities remain distinct and separate, further limiting cross sector cooperation

Credits to: Jake Ellowitz Itamar Novick Jenny Xiao Joe Wilson, and 25 enthusiastic LPs at the event who all contributed great insights, questions, observations